Affordable Contributions

You can open a Learning Quest Education Savings Account with any amount. There are several convenient ways to contribute to your savings. You can open an account with a one-time payment or recurring contributions from your bank account or paycheck. You can also directly deposit from sources such as Social Security payments or military allotments.

Learning Quest has a high contribution limit of $550,000 per beneficiary. This is based on the average expenses of five years of higher education at a private institution.

You can maximize your savings by starting early and contributing consistently. Over time, this makes a big difference. Putting your contributions on a regular, fixed-dollar schedule allows you to have a solid plan — you're not rushing to contribute every month or, worse yet, not contributing at all because the money was spent elsewhere.

Regular Investing Pays Off

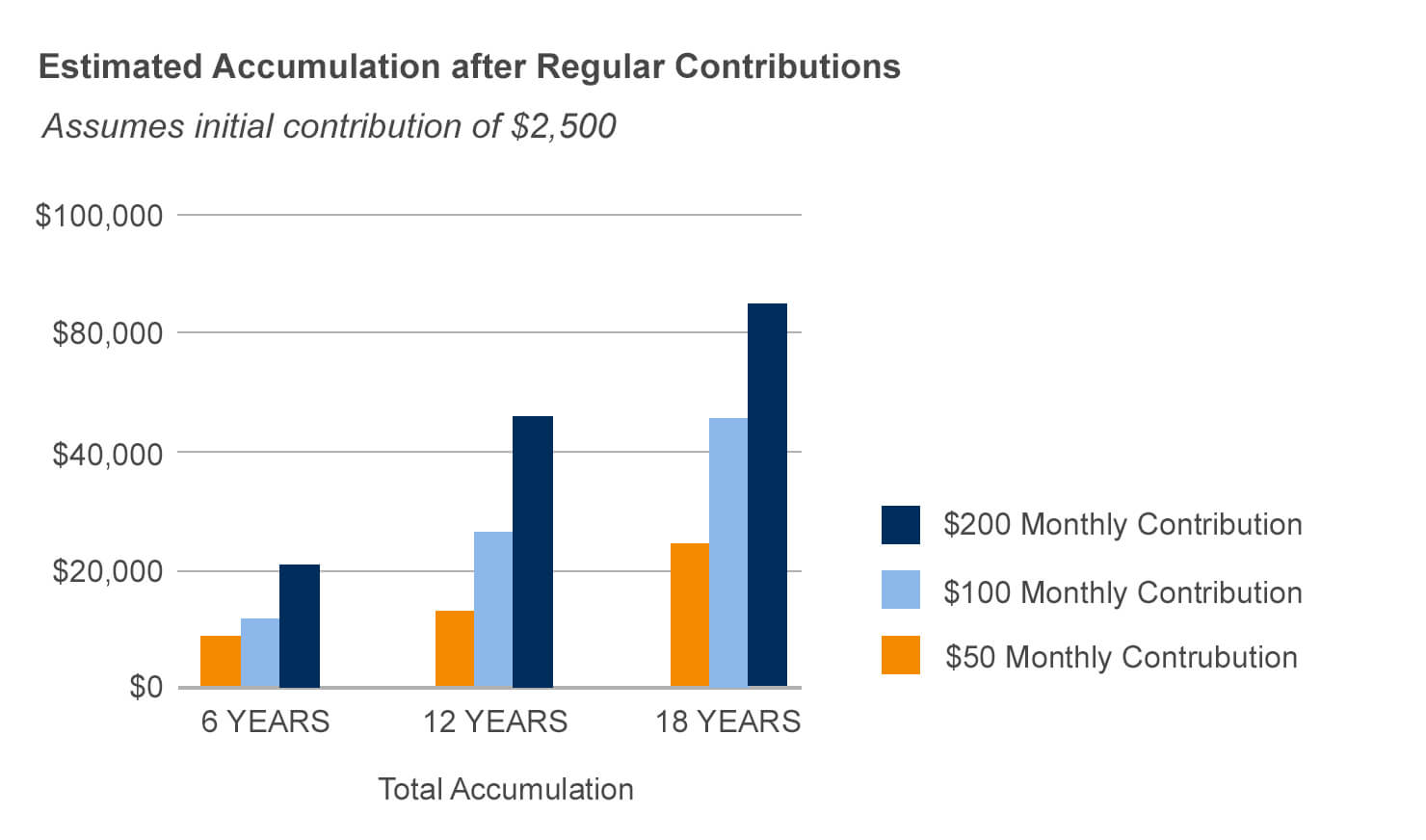

Recurring contributions are a convenient and efficient way to help you take advantage of market trends, and are key to helping your savings grow. The chart below shows the growth of recurring contributions in increments of $50, $100 and $200 over time, beginning with a balance of $2,500.

Chart based on these assumptions: Monthly investment is made at the beginning of each month. Investment begins with a balance of $2,500 and earns an 6% average annual return. All projections are before taxes are paid. This information is for illustration purposes only and is not intended to represent any particular investment product.

Finding Extra Funds

Review your current financial situation to determine how much you can afford for a recurring contribution. It's helpful to track your spending for a few weeks to see when and where you spend "extra" money. For example, maybe you could save $50 or $100 by not eating out at restaurants as often. Priortize your spending, then start saving consistently — even if it's a small amount — to help meet your goals. The payoff? A brighter future for your child.

Here are some ways you may be able find extra money to start a college savings account:

- Tax refund

- Career pay raise

- Paying off loans or debt

- When your child stops attending day-care and enters school

- Making life-style changes, such as reducing entertainment costs

- Changing your federal and state tax exemptions to increase your take-home pay