529 Contribution Limits

You may contribute to your college savings account at any time. You can open a Learning Quest Education Savings Account at any amount. And, there are several convenient ways to contribute to your investment.

Learning Quest has a high contribution limit of $550,000 per beneficiary. This is based on the average expenses of five years of higher education at a private institution.

Make a contribution to a Learning Quest college savings account through:

You can set up an automatic, or recurring, contribution from your paycheck, savings account, checking account, military allotment or Social Security payment.

Consistent contributions (e.g., monthly or bi-weekly) make a significant difference over time. Putting your contributions on a regular, fixed-dollar schedule allows you to have a solid plan — you're not hassling with getting it done every month or, worse yet, not doing it at all because the money was spent somewhere else.

Recurring contributions are convenient and efficient, help you take advantage of market trends, and are key to helping your college savings compound long-term.

You may contribute to your account at any time. You can open a Learning Quest Account with any amount. You may have certain instances, such as receiving a tax refund, an inheritance or a work bonus, where a lump-sum contribution makes sense to maximize your investment.

Reduce your personal taxable estate through "accelerated gifting". This allows you to make up to five years' worth of gifts ($95,000 if single/$190,000 if married, filing jointly) to a Learning Quest account in a single year without being subject to gift taxes. This benefit is unique to 529 college savings plans like Learning Quest. Generally, your contributions to the account are removed from your taxable estate.1

NOTE: The gift tax exclusion amount is adjusted annually. To qualify, you'll need to file IRS Form 709 (Instructions for Form 709) to treat the gift as if it were made in equal payments over five years. To avoid gift tax, you should make no additional gifts to the beneficiary during that time. If a new beneficiary is named who is two or more generations younger than the current beneficiary, a generation-skipping tax may apply. You should consult a tax advisor to determine if you need to file this form.

Gifts to your child’s Learning Quest account could help you reach your education goals. For any occasion, giving the gift of education is the gift that will last a lifetime.

Ugift® is a free service that lets family and friends give the gift of college savings.

How Ugift works:

Account owners share the Ugift code so friends and family can easily contribute to the account. Gift givers can make the gift contribution online through electronic bank transfer or by check, and simply enter the Ugift code.

New! Personalized Gifting Page for Crowdfunding

A new innovative gifting capability makes it easier than ever to ask friends and family to give a gift to your Learning Quest account. You can create a Ugift crowdfunding goal page to help family and friends contribute. Personalize it with a picture and information about your goal. Once it’s set up, easily share it with friends and family through Facebook, Twitter and email. Anyone with a link to your goal page can make a gift contribution through electronic funds transfer.

Your family and friends are going to give gifts for those special occasions or anytime, why not help them give the gift of education?

Get started by logging into your account.

Crowdfunding College? Another Way to Save

You’ve heard it a million times: College costs are skyrocketing. You need to start saving early. Get started now.

But when it comes to something that’s years away, it can be hard to sock away real money and put a college savings plan into action. It’s time to get realistic about how much you need for your child’s education, the best ways to save and how to avoid debt down the road.

College Costs Are Rising…But How Much?

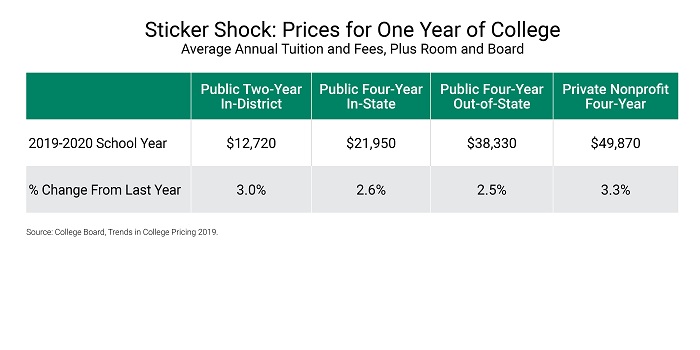

Even considering the price differences between two- and four-year, public and private options, the costs can quickly get overwhelming.

How Are Other Families Paying?

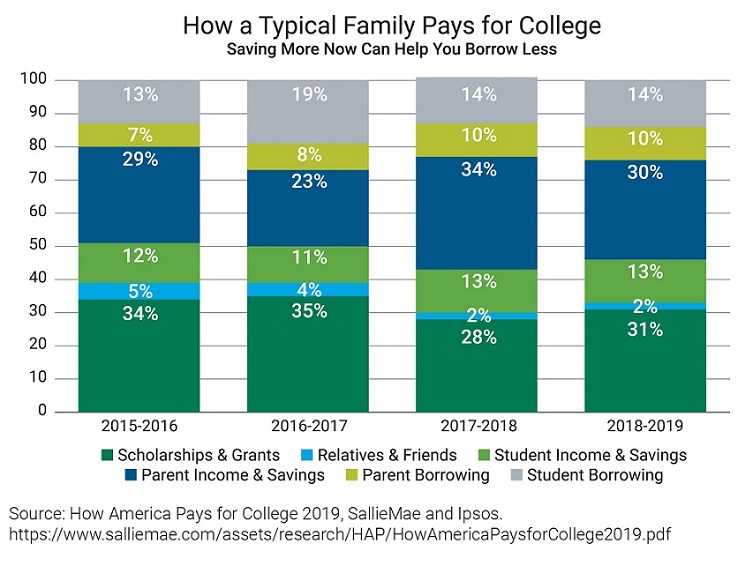

Most families pay for college through a combination of current paychecks, savings, scholarships or grants, and particularly, loans. In fact, more than 20% of funding for the 2018-19 school year came from parent and student loans, piling on debt for families and young adults.

Another Way to Save: Crowdfunding

Crowdfunding has become popular for a variety of expenses. Parents are recognizing that small amounts from lots of people have the potential to grow big over time.

What if you replaced a portion of your usual gift amount with contributions toward college savings? And what if your friends and family did the same?

An Easy Way to Crowdfund Your 529 Account

Through the Learning Quest® 529 Education Savings Program, it’s easier than ever to set up a crowdfunding page specifically for your child’s college journey.

Invite family and friends to a personalized online gifting page where they can give money straight from their bank account to a Learning Quest account. And best of all, there are no fees for this gifting service.

Set Up a Gifting Page

- Log in to your Learning Quest 529 account and click on the Ugift® link. Don’t have a Learning Quest account? Click here to learn more about the benefits of 529 plans.

- Set a saving goal for an upcoming occasion: birthday, holiday, graduation or other milestone.

- Add a description of your goal, a photo and choose an end date. The page will count down the days left to send a gift for your chosen occasion.

- Only someone with the link to your gifting page will be able to see it. As the account owner, you decide who gets the link.

Invite Friends and Family

- Once you’ve set up your gifting page, you can share the link through social media or by email.

- Gift givers can click on Give a Gift to choose an amount and add their name and bank information. You’ll receive a deposit confirmation when the gift is added to the account.

- Creating a Gift Giver profile is optional, but it will let them give future gifts more quickly, send gifts to multiple recipients, view gift history and set up recurring gifts.

Small Gifts May Add Up to Big Dreams

The online gifting page is also a good way to engage your child in the college process. Together, you can watch your 529 savings grow over time, and your child will see how regular additions—no matter how big or small—can help turn college dreams into reality.

Rethink the Wish List: How to Ask for College Money

- For the “I never thought of it” crowd: Make sure they know college savings is a real, welcome gift option.

- For the “I want to give a real gift” crowd: Suggest that money for college be a portion of a regular present instead of either/or.

For the “Kids have too much stuff” crowd: This is the perfect gift to avoid adding more toys to the pile.

How do I get started with UGift?

Log into your Learning Quest account and go to Ugift. If you don’t have a Learning Quest account, click here to open an account.

Can I control who sees my college savings gifting page?

Yes, only someone with the link to your gifting page will be able to view it. As the account owner, you decide with whom you want to share the link.

Can people making gifts see my Learning Quest account information?

No.

How do I invite people to view my college savings gifting page?

Once you’ve set up your gifting page, you will have options for sharing a link on Facebook, Twitter and by email.

Can I edit my gifting page once it is set up?

Yes, you may edit your gifting page at any time.

How will I know if I received a gift?

You will receive a deposit confirmation just as you do today with contributions to your 529 account. To see who made the gift, click on Ugift through your Learning Quest account and then view Gift History. You’ll see a list of gift contributions and who made the gifts.

Are there any fees associated with this service?

No, this is a free service; there is no fee charged to the gift giver or the account owner.

What if I have a question about a gift made to my account?

You can contact a Learning Quest Specialist at 800-579-2203 for assistance.

How long will my goal page exist?

You set the expiration date up to a maximum of six months.

How will someone actually give the gift of college savings?

The gift-giver can easily complete e-check (electronic check) option with information from their account (bank routing number and bank account number). The amount of the gift will be debited from their bank account using an ACH transaction into the Learning Quest account.

Can gifts be made electronically by options other than e-check?

At this time, e-check is the only option for gifting through the personalized gifting page. However, a form is provided on the page for those who would like to mail in a check instead of transacting the gift through electronic bank transfer.

Does the gift count towards my 529 contribution limit?

Yes, your Learning Quest account has a total balance maximum contribution limit. When the account reaches the max contribution limit, Ugift is not disabled and a goal can be created, however, gifts would be rejected.

1 In the event you do not survive the five-year period, a pro-rated amount will revert back to your taxable estate.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

The availability of tax or other state benefits (such as financial aid, scholarship funds and protection from creditors) may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

No additional gifts can be made to that beneficiary over the next four years after the year in which the one-time gift is made.

If the donor of an accelerated gift dies within the five-year period, a portion of the transferred amount will be included in the donor's estate for estate tax purposes. Consult with a tax advisor regarding your specific situation.

Gift contributions received by the Learning Quest Plan will be invested according to the allocation instructions on file for the account at the time the gift contribution is transferred into it. Gift contributions transferred into the beneficiary’s account shall be governed by the terms and conditions of the Learning Quest Handbook. There may be tax consequences of gift contributions invested in a 529 account. The Plan reserves the right to invest gifts received into the beneficiary’s account regardless of whether the account has been previously closed.